Rentsync National Rental Demand Report: August 2022

Executive Summary

In this comprehensive national rental demand report, we outline significant changes in unique leads per property across Canada. The data presented here is the largest data-backed analysis of rental market demand in Canada using aggregate ILS data (over 20 rental listing sites).

The data included in the Rentsync National Rental Demand Report can be used to compare and contrast demand and lead volume for the properties you manage within a given city and will allow you to make more sound decisions on marketing and advertising.

As you observe demand and unique lead volume percentage, it's possible to measure this against your own metrics, and see whether you are in line with current industry trends, and if not, how to pivot your strategies as a result.

Methodology

To present this data, Rentsync has determined three key calculations for each area of the report, they are as follows:

Demand Score: Our demand score is rated out of 10 (with 10 being the highest score a city can receive), and is calculated based on unique leads per property, per city, and compared against benchmark data.

For Example: East York, ON received a demand score of 9.7 this month, versus 7.9 last month. Meaning East York experienced a 1.8 point shift in its demand score.

Demand Percentage (% +/-): This is determined according to the year-over-year (YOY) or month-over-month (MOM) increase or decrease in unique leads per property.

For Example: The month-over-month unique leads per property in East York, ON went up 23% in July versus June 2022 making it the highest achieving market in July. In July 2022, the year-over-year Demand Score in East York, ON went up 4.2 points representing an increase of 77% from July of 2021.

Position: The position is determined by unique leads per property, with cities that have at least *20 properties or more. The position will vary depending on demand.

For example: This month, East York, ON moved up to achieve the top spot on our Top 40 Canadian cities in Demand rankings, up 30 spots from last year.

*The following report provides month-over-month rental listing data for July 2022 versus June 2022, as well as a year-over-year comparison from July 2022 versus July 2021. It also outlines the month-over-month and year-over-year trends in primary, secondary, and tertiary markets.

Key Takeaways:

Month-over-month (M/M): July witnessed the acceleration of recent market trends with renter interest growing at a disproportionately high rate, while available supply slowly shrinks. Unique leads grew by +10.5%, and available properties declined by -3%, which resulted in the average prospects per property increasing by +11.7%. Although demand continues trending upwards, the upward movement of rents has slowed significantly month-over-month with 1-bedroom rents increasing by only 1% across the top 40 markets down from 2% growth in June 2022. Many renters are also beginning to look to smaller communities recognizing the lessened availability of units in primary markets which further spreads the increased load of rental demand. Renters have also continued expanding the scope of their rental searches with the average lead volume per prospect increasing by +4% month-over-month.

Month-Over-Month (M/M)

- Primary: Demand scores are up +12%

- Secondary: Demand scores are up +21%

- Tertiary: Demand scores are up +14%

*Demand scores have reversed recent trends and begun increasing across the country. This is mostly due to the leveling of demand across secondary markets, primarily Surrey, which attracted a disproportionate number of prospects and artificially depressed demand scores across the country. With Surrey no longer holding the top spot, demand scores are more representative of the actual demand being experienced across much of the country. Demand remains strong across the country, with secondary markets achieving the greatest monthly growth.

Property availability continues to decline across the country, while the number of prospects grows. Partially due to seasonality with warm weather driving households to move, the continued tightening of interest rates has also pushed many into the rental market with many households who would otherwise purchase a home relegated to renting. Inquiries to single-family homes have grown an average of +15.4% per month over the past 3 months.

Year-over-year (Y/Y): Overall, in Canada, our multifamily demand score shows an increase of +27% in July 2022 versus July 2021. Both unique leads per property and property availability are down -39% and -45% respectively. This decrease is primarily due to the strong leasing activity experienced over the last 12 months which allowed many of the properties left vacant during the pandemic to be released and taken off the market. The loss of prospects can also be partially attributed to the loss of the Facebook marketplace as a source of leads. Overall, the year-over-year (July '22 vs July'21) market snapshots are as follows:

Year-Over-Year (Y/Y)

- Primary: Demand scores are up +42%

- Secondary: Demand scores are up +42%

- Tertiary: Demand scores are down -21%

*The year-over-year analysis indicates that rental demand has maintained an upward trajectory across primary and secondary markets. Due to strong leasing activity and maintained demand, rental markets have fully recovered from their pandemic lows. Although tertiary markets are down year-over-year this is only compared to COVID’s peak when many households were driven from primary markets, whereas more recent trends show growing continued demand.

.

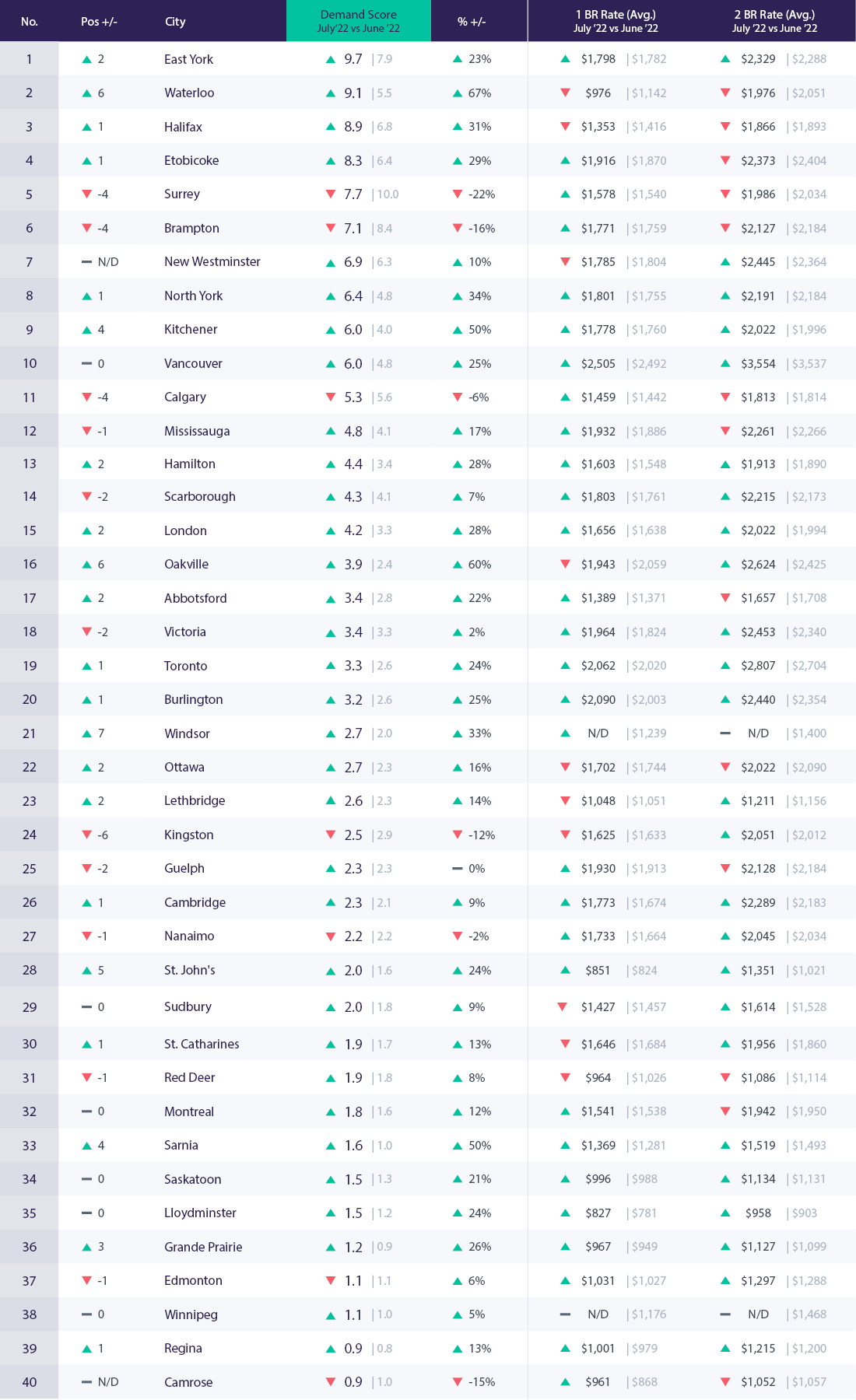

Top 40 Canadian Cities in Demand

*Demand is determined by calculating unique lead volume per property by market. Due to a decrease in available properties in the rental housing market, this report will only highlight the top 40 cities in Canada based on our threshold that requires at least 20 properties to be included in our data sample.

Notable Changes in Demand Over the Past Month

Canadian cities experienced varying levels of growth month-over-month. Primary markets experienced the smallest relative growth in demand scores, followed by tertiary markets, and lastly, secondary markets which showed the greatest growth in prospects; along with the greatest decline in property availability. Overall rankings have shifted substantially with Surrey being pushed down to fifth place and replaced at the top of our rankings by East York.

Top 10 Canadian Cities in Demand Drill Down (M/M): July 2022 vs. June 2022

Key Trends for Top 10 Canadian Cities in Demand (M/M)

July saw the top ten list dominated almost exclusively by secondary markets, with North York and Vancouver representing the only primary markets to make the top ten. The only tertiary market, East York, made the list at the top spot. Surrey and Brampton which showed strong growth throughout 2022 are showing signs of slowing down with a reduction in the number of prospects. The remaining markets showed an average monthly growth of +28% in unique prospects.

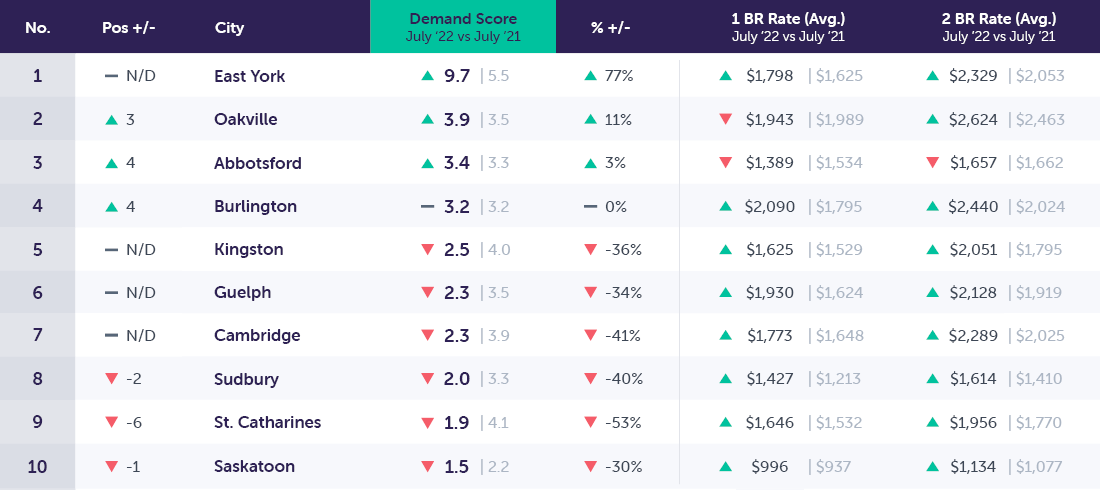

Top 10 Canadian Cities Drill Down (Y/Y): July 2022 vs. July 2021

Key Trends for the Top 10 Canadian Cities in Demand (Y/Y)

*Year over year we have seen the ongoing normalization of renter traffic and inquiry volumes. Demand scores are up on average +72%. This figure is down month-over-month suggesting further normalization of trends. Besides East York, Etobicoke, and North York all other markets have seen a decline in prospective renters from July 2021. Property availability is down across all 10 markets with an average decline of -48% year-over-year. The significant decline in both prospects and property availability is due to the strong leasing activity experienced over the past 12 months which enabled a vast majority of vacant units to be reoccupied.

East York now tops the list whereas last year's top 10 list was primarily made up of primary markets likely due to the renewed interest in primary markets which occurred towards the end of summer 2021.

Rent growth amongst the top 10 markets while strong at +11% year-over-year for 1 bedroom units is down from last month's figure of +12%. Although still up, the gradual lessening of rental rate increases suggests that rents may be cooling and that we may see a continued albeit gradual decline in growth figures.

An Analysis of Key Canadian Markets

In order to better segment our data and analyze what is happening within specific markets across Canada, we have broken down our data into 3 key market segments:

- Primary (Populations Over 600K)

- Secondary (Populations Between 600-235K)

- Tertiary (Populations Between 235-100K)

Here we will gain a deeper perspective on demand across larger population centers and trends in various markets.

Key Takeaways:

In July, renter demand increased by +10.5%, while property availability declined by -3%. This had the effect of increasing average prospects per property by +14%. Renters have recognized the increased competition they are facing and continue submitting a greater number of inquiries when looking for new housing leading to greater overall lead volume.

The disproportionate increase in prospects relative to available properties is due in part to the growing unaffordability of home-ownership which continues to push more households towards renting which will only continue enlarging the pool of prospective renters over time. This has resulted in family-oriented properties receiving a disproportionate number of leads and increasing competition for larger multi-bedroom properties.

Primary Markets (Populations >600K)

Primary Market Drill Down (M/M): July 2022 vs. June 2022

Notable Changes in Primary Markets Over The Past Month

*Overall unique leads per property increased by +8.6%, and demand scores have increased by +12% in primary markets this month.

Primary markets saw the lowest relative growth in overall demand metrics underperforming both secondary and tertiary markets in regards to both unique prospects and average lead volume growth. However, while down compared to smaller markets these figures remain up from May & June suggesting that overall demand continues to rise across much of the country.

Property availability in primary markets continued the decline at -2.8% month-over-month, while average prospects per property increased by +11.7%. Once again although these figures are lower than secondary and tertiary markets, they are up significantly from June suggesting that the gap between demand and supply will continue to expand. The shift in growth to smaller markets has lessened primary markets' overall coverage of renters by approximately 0.6% suggesting a gradual shift in renters once again.

Primary Market Drill Down (Y/Y): July 2022 vs. July 2021

Notable Changes in Primary Market Demand Over The Past Year

*Year-over-year demand scores are up +42% however both prospects and available properties are down -32% and -46.

Tighter market conditions resulting from a decline in the number of prospects and a much greater decline in property availability have left overall demand scores up and average prospects per property up +24% year-over-year. Rental rates have shown healthy growth over the last year with a +11.8% increase for one-bedroom units experienced by primary markets.

Many markets have returned to their pre-COVID availability rates and are trending towards substantially tighter market conditions suggesting that while rental affordability remains the hot topic of discussion the much more real and pressing issue affecting primary markets is that of availability.

Secondary Markets (Populations ~600-235K)

Secondary Markets Drill Down (M/M): July 2022 vs. June 2022

Notable Changes in Secondary Market Demand Over The Past Month

*Secondary markets saw the most substantial decline in property availability at -8.5%, while unique renters are down -11% year-over-year.

Much of this list is dominated by Ontario markets with the exceptions of Surrey, Halifax, and Victoria. These markets represent semi-urban markets with strong fundamentals and growing demand for housing.

Rental rate growth has slowed to +1.8% for 1-bedroom units, down from last month's growth rate of +2.4%. While monthly rates may vary, this slowdown during what is otherwise the height of leasing season may be indicative of a broader cooling of rent growth in the coming months.

While there remains a clear preference amongst many to live in primary markets, secondary markets continue to offer substantial value to renters and attract a growing population of renters monthly.

Secondary Market Drill Down (Y/Y): July 2022 vs. July 2021

Notable Changes in Secondary Market Demand Over the Past Year

*Overall, year-over-year demand scores are up +42%, while prospects are down -44%, and properties are down -55% in secondary markets.

The significant increase in demand scores is due to the imbalance between property availability and renter demand which only continues to grow when compared to the previous year. Demand amongst secondary markets has also experienced a substantial shift in the ranking of markets such as Halifax and Etobicoke taking on the first and second places amongst available secondary markets in the list.

Rental rate growth was highest amongst secondary markets with an average increase of +13.7% for 1 bedroom units. This figure, unlike primary and tertiary markets, is up from June suggesting that the shift in renter demand towards markets with greater availability has enabled these communities to further push their rental rates.

Tertiary Markets (Populations ~235-100K)

Tertiary Markets Drill Down (M/M): July 2022 vs. June 2022

Notable Changes in Tertiary Market Demand Over The Past Month

*Demand scores in tertiary markets increased by +14%, unique prospects increased by +14%, and available properties decreased by -0.2%.

The increase in prospective renters is likely similar to the increase experienced by secondary markets. With primary markets becoming increasingly more competitive and undersupplied many have begun to look to smaller markets where property availability is less prevalent.

Property counts remain relatively stable declining only -0.2% month-over-month. This may be because many prospects have only begun looking at tertiary markets as viable options suggesting that in the coming months we are likely to see a further decline in the supply of properties in tertiary markets.

Rental rates have also slowed within tertiary markets and are up +0.55% month-over-month for 1-bedroom units which is down from the +2.25% increase experienced in June.

These are not negative indicators for tertiary markets as these communities offer prospective renters less competition and a lower cost of living which attract households who become priced out of larger communities.

Tertiary Markets Drill Down (Y/Y): July 2022 vs. July 2021

Notable Changes in Tertiary Demand Over the Past Year

*Overall, year-over-year demand scores are down in tertiary markets by -21% Unique prospects are down -49%, while properties are down -27%.

Rental rate growth in line with larger communities has slowed year-over-year however this is primarily driven by several markets experiencing minor contractions in rents which have driven down average values.

The higher decline in prospects than properties is likely due to the shift in focus for many households post-pandemic. Amidst the pandemic, many flocked to smaller communities. Whether to get away from the congestion of larger cities or to improve their access to green space; tertiary markets experienced substantial growth over the past 2 years. Since then much of this growth has been wiped away. Many households have returned to larger and better-amenitized markets. The push for a return to office further accelerated this by creating a need to be in proximity to employment centers which once again disincentivized many from looking at tertiary markets for housing.

Although demand may be waning it says little about their long-term trajectory. These communities offer substantial value for households who may not be required to live near work or want the quality of life offered by smaller communities.

Conclusion

While July saw the continuation of tightening market conditions experienced over the past quarter, it also brought about a shift in outlook and renter demand which we are likely to continue seeing through the remainder of the year. Demand scores trended upwards due mostly to the stabilization of markets that had previously eclipsed much of the gains in what would otherwise be less competitive rental markets.

Unique prospects continue to grow across the country, while property availability shows no sign of slowing down month-over-month. The only saving grace is that many of those entering the rental market were those priced out of purchasing a home and are now looking for family-friendly accommodations. This means that much of the growth in renter traffic focuses on larger apartments and single-family homes.

Faced with limited supply and shrinking affordability renters have begun moving back to secondary and tertiary markets. These communities experienced strong growth throughout the pandemic, but have since lost much of their appeal when markets reopened and renters were driven to communities with strong amenitization over those with small town appeal. This shift towards smaller markets may be a result of the pricing out that has occurred in primary markets. Primary markets have experienced strong rent growth which was also fueled by those who had sold their homes and instead of buying once again chose to hold their equity and rent while market conditions settle. This influx of wealth into the rental markets of primary markets allowed for further price increases which have only worsened affordability.

With lacking affordability renters who have been priced out are now looking further afield for housing options and are inquiring about secondary markets at an increasing rate. As a result, while the rent growth in primary markets gradually slows, secondary markets are showing strong monthly gains suggesting that they have not reached their peak.

Rental availability will unfortunately be a problem that persists in a majority of Canadian rental markets well into the future. While affordability on the surface seems like the more pressing issue; it is only a byproduct of tightening market conditions and a general imbalance between the demand and supply of rental product. With no end in sight, we recommend that property owners and managers carefully consider their market position, how their properties are presented, and lastly what steps they take when reviewing rental applications. When competition is at its highest is when property managers have to be the most careful when selecting tenants.