Rentsync National Rental Demand Report: January 2021

Executive Summary

In this comprehensive national rental demand report, we outline significant changes in rental market demand across Canada. The data presented here is the largest data-backed analysis of rental market demand in Canada using aggregate ILS data (over 20 rental listing sites).

The data included in the Rentsync National Rental Demand Report can be used to compare and contrast demand and lead volume for the properties you manage within a given city, and will allow you to make more sound decisions on marketing and advertising.

As you observe demand and lead volume percentage, it's possible to measure this against your own metrics, and see whether you are in line with current industry trends, and if not, how to pivot your strategies as a result.

Methodology

In order to present this data, Rentsync has determined three key calculations for each area of the report, they are as follows:

Demand Score: Our demand score is rated out of 10 (with 10 being the highest score a city can receive), and is calculated based on unique prospects, per property, per city, and compared against benchmark data from the past 12 months.

For example: Oshawa, ON received a demand score of 4.2 this month, versus 4.5 last month. Therefore, Oshawa experienced a decrease in demand (unique prospects per property) by 0.3 points this month.

Unique Prospects Percentage (% +/-): This is determined according to the year-over-year (YOY) or month-over-month (MOM) increase or decrease (aka the demand) in unique prospects per property / per city.

For example: The month-over-month unique prospects in Oshawa, ON went down 10% in December versus November. In December 2020, the year-over-year unique prospects in Oshawa, ON went up 18% compared to December 2019.

Position: The position is determined by unique prospects per property, with cities that have at least *20 properties or more. Position will vary depending on demand.

For example: This month, Oshawa, ON remained steady in 2nd position versus last month due to a relatively stable month-over-month change (10% decrease) in prospects per property. Whereas Abbotsford, BC moved up 1 spot (from 4th to 3rd on the list). This due to the fact that Richmond Hill, which was 3rd on the list last month, had fewer than 20 properties this month and was no longer included in this month's data set. Therefore, Abbotsford, BC moved up, after once again, a relatively stable change in prospects per property (a decrease of 5%).

*The following report provides month-over-month ILS data for December versus November 2020, as well as a year-over-year comparison from December 2020 versus December 2019. It also outlines the month-over-month and year-over-year trends in primary, secondary, and tertiary markets.

Key Takeaways:

Month-over-month (M/M): Overall, total unique prospects from November to December decreased 5.2%, additionally an overall increase in supply (+1.2%) from November to December, in Primary (+1.3%), and Tertiary (2%) markets, slightly impacted the number of unique prospects per property in these regions the most.

It is possible to hypothesize that the decrease in demand is due to seasonal declines as well as a consequence of government lockdowns in specific metropolitan areas due to COVID-19 prevention as cases continue to rise in Canada.

However, it is important to note that secondary markets saw a decrease in supply (-4.7%) this month. These areas also experienced the most cities with the highest increase in demand. The report shows that 5 (out of the 10) cities in secondary markets actually increased their demand scores in December versus November, including, Surrey, BC (+0.3), Brampton, ON (+0.5), Etobicoke, ON (+0.5), Victoria, BC (+0.1), and Quebec City, QC (+0.4).

Cities with Notable Upward Changes (M/M) - Dec 2020 vs Nov 2020

- Peterborough, ON moved up 18 spots, and saw an increase in demand of +1.0, and a 34% increase in unique prospects per property.

- Brampton, ON moved up 15 spots, and saw an increase in demand of +0.5, and a 20% increase in unique prospects per property.

- Etobicoke, ON moved up 13 spots, and saw an increase in demand of +0.5, and a 17% increase in unique prospects per property.

- Quebec City, QC moved up 16 spots, and saw a +0.4 increase in demand, and a 19% increase in unique prospects per property.

- Scarborough, ON reduced demand by -0.3 points and experienced an 21% decrease in unique prospects per property this month. This was the most dramatic decrease in demand for primary markets this month.

Cities with Notable Downward Changes (M/M) - Dec 2020 vs Nov 2020

- North Vancouver, BC dropped 19 spots, and reduced demand by -1.2, experiencing the highest decrease in unique prospects per property (-44%) this month in the top 50 list.

- Halifax, NS saw a -0.6 point decrease in demand and a 33% decrease in unique prospects per property, the greatest decline in secondary market cities this month.

- Sudbury, ON saw a -0.4 decrease in demand and a 20% decline in unique prospects per property this month versus last month.

- Oakville, ON went down -0.4 demand points and declined 22% in unique prospects per property.

Year-over-year (Y/Y): Overall unique prospects for multifamily residential housing is actually up 21.3% this year, versus the same time last year, however, supply is also up 35.3% with more than 3,053 new properties entering the long-term rental market this year versus the same time last year.

Therefore, increased supply has impacted unique prospects per property across the majority of Canadian cities year-over-year. As more supply floods the market (i.e. Airbnbs), demand is being spread out.

There continues to be a consistent downward trend in Primary and some Secondary markets that are more densely populated, and have higher rent rates. We can provide a thesis that this is due to COVID-19's impact on migration away from urban city centers to locations with more space and more affordable housing, as remote work continues to increase.

Cities with Notable Upward Changes (Y/Y) - Dec 2020 vs Dec 2019

- Oshawa, ON moved up 7 spots this year, increased demand by +0.8 points, and experienced an increase of 18% in unique prospects per property this year versus last year.

- Nanaimo, BC moved up 32 spots on the list, increased demand by 1.3 points, and increased unique prospects per property by 53%.

- Victoria, BC had a +0.4 increase in demand, and a 27% increase in unique prospects per property versus this time last year.

- Richmond, BC experienced the greatest increase in demand, increasing +0.7 demand points and 57% unique prospects per property this year versus this time last year.

Cities with Notable Downward Changes (Y/Y) - Dec 2020 vs Dec 2019

- Montreal, QC experienced a -1.8 point decrease in demand, and a 64% decline in unique prospects per property from last year.

- Toronto, ON decreased demand by -0.8 points and saw a 47% decline in unique prospects per property

- Surrey, BC decreased in demand by -3.9 points and had a 42% decline in unique prospects per property this year versus this time last year.

- Brampton, ON decreased in demand by -2.0 points, and saw a decline in unique prospects per property by 52% this year versus last.

- Etobicoke, ON demand decreased by -3.9 points and saw a 41% decline in unique prospects per property.

- Hamilton, ON decreased in demand by -0.6 points this year and experienced a 54% decline in unique prospects per property this year versus this time last year.

- Halifax, NS saw a 0.9 point decrease in demand and a 41% decrease in unique prospects per property.

- Oakville, ON saw a decrease in demand by -3.5 and a 62% decline in unique prospects per property this year versus this time last year, the biggest decline (equal to Nepean, ON) by tertiary cities this year versus last year.

- Nepean, ON experienced a 1.9 point decline in demand, and a 62% decrease in unique prospects per property versus this time last year.

Top 50 Canadian Cities in Rental Demand

*Demand is calculated using unique prospects per property per city for Dec 2020 versus Nov 2020

Notable Changes in Demand Over the Past Month

Upwards

- Western cities such as Surrey, BC (+0.3), Namaino, BC (+0.4), Coquitlam, BC (+0.3) and Victoria, BC (+0.1) all experienced an increase in demand this month from the previous month.

- Peterborough, ON moved up 18 spots, and saw an increase in demand of +1.0, and a 34% increase in unique prospects per property.

- Waterloo, ON moved up 9 spots, and saw an increase in demand of +0.2, and a 10% increase in unique prospects per property.

- Brampton, ON moved up 15 spots, and saw an increase in demand of +0.5, and a 20% increase in unique prospects per property.

- Etobicoke, ON moved up 13 spots, and saw an increase in demand of +0.5, and a 17% increase in unique prospects per property.

- North York, ON moved up 6 spots, and saw an increase in demand of +0.2, and a 5% increase in unique prospects per property.

- Barrie, ON moved up 9 spots, and saw an increase in demand of +0.2, and a 9% increase in unique prospects per property.

- Quebec City, QC moved up 16 spots, and saw a +0.4 increase in demand, and a 19% increase in unique prospects per property.

- East York, ON moved up 4 spots, and saw an increase in demand of +0.1, and a 7% increase in unique prospects per property.

- Sherwood Park, AB entered the top 50 list, and saw a 0.1 increase in demand, and an increase of 5% unique prospects per property this month.

Downwards

- New Westminster, BC dropped 6 spots this month, reduced demand by -0.3 points, and saw a 16% decrease in unique prospects per property.

- Welland, ON dropped 8 spots, a reduced demand by -0.4 points, and 21% decrease in unique prospects per property this month.

- Sudbury, ON dropped 5 spots, reduced demand by -0.4, and decreased unique prospects per property by 20%.

- St. Catharines, ON dropped 1 spot, reduced demand by -0.4 points, and 16% in unique prospects per property this month.

- Oakville, ON dropped 4 spots, reduced demand by -0.4 points, and saw a 22% decrease in unique prospects per property.

- Burlington, ON dropped 8 spots, reduced demand by 0.4, and experienced a decrease of 26% in unique prospects per property.

- Cambridge, ON dropped 1 spot this month, decreased demand by -0.3 points, and had a decrease of 21% in unique prospects per property.

- East York, ON dropped 8 spots, reduced demand by -1.2, and a reduction of 16% in unique prospects per property this month.

- Halifax, NS dropped 7 spots, reduced demand by -0.6 points, and saw a 33% reduction in unique prospects per property.

- Kamloops, BC dropped 7 spots this month, had a reduced demand of 0.4 points, and a decrease of 18% unique prospects per property.

- Scarborough, ON dropped 3 spots, reduced demand by 0.3 points, and saw a decrease of 21% in unique prospects per property.

- North Vancouver, BC dropped 19 spots, reduced demand by -1.2, and experienced the highest decrease in unique prospects per property (-44%) this month.

- Nepean, ON dropped 1 spot, reduced demand by -0.2, and a 16% decrease in unique prospects per property.

- Vancouver, BC dropped 1 spot, reduced demand by -0.2, and a 16% decrease in unique prospects per property.

- Richmond, BC dropped 6 spots, reduced demand by -0.3, and a 22% decrease in unique prospects per property.

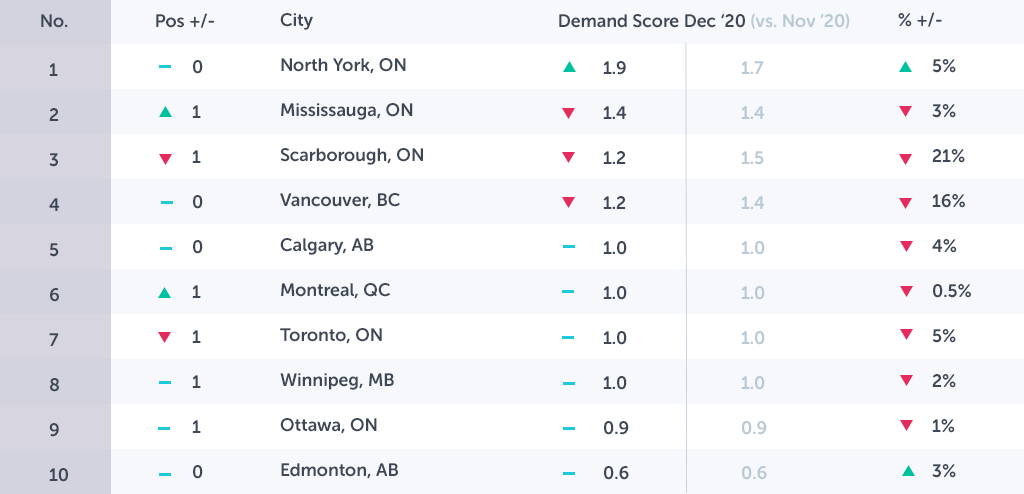

Top 10 Canadian Cities in Demand Drill Down (M/M): Dec 2020 vs. Nov 2020

Key Trends for Top 10 Canadian Cities in Demand (M/M)

- Surrey, BC remained at the top spot this month, experiencing an increased demand of +0.3 point, and an increase of 2% in unique prospects per property.

- Oshawa, ON remained in second position, but saw reduced demand of -0.3 points, and a 10% decrease in unique prospects per property.

- Abbotsford, BC moved up 1 spot this month, and saw a slight decrease in demand of -0.1 points, and -5% in unique prospects per property.

- Peterborough, ON was the highest performing city this month, moving up 18 spots on the list, and saw a +1.0 increase in demand, and a 34% increase in unique prospects per property for the month.

- Nanaimo, BC moved up 5 spots, experienced an increased demand of +0.2 points, and a 5% increase in unique prospects per property for the month.

- Kitchener, ON moved down 1 spot this month, decreased demand by -0.2 points, and decreased unique prospects per property by 9%.

- Waterloo, ON moved up 9 spots, had an increase in demand of 0.2 points, and a 10% increase in unique prospects for the month.

- Burnaby, BC moved up 1 spot on the list, but saw a small decline in demand by 0.1, and 8% decrease in unique prospects per property.

- Brampton, ON moved up 15 spots this month, and saw an increase of +0.5 points, and a 20% increase in unique prospects per property.

- Etobicoke, ON moved up 13 spots this month, and experienced an increase of +0.5 demand points, and +17% unique prospects per property.

Top 10 Canadian Cities Drill Down (Y/Y): Dec 2020 vs. Dec 2019

Key Trends for the Top 10 Canadian Cities in Demand (Y/Y)

- Surrey, ON remained in the top spot from this time last year, but decreased demand by 3.9 points, and decreased 42% year-over-year in unique prospects per property.

- Oshawa, ON moved up 7 spots this year, increased demand by +0.8 points, and experienced an increase of 18% in unique prospects per property this year versus last year.

- Abbotsford, BC moved up 11 spots this year, but decreased demand by -0.1 points, and saw an decrease of 4% in unique prospects per property.

- Peterborough, ON moved up 9 spots this year versus last year, but also saw a decreased demand of -0.5 points, and a 17% decrease in unique prospects per property.

- Nanaimo, BC moved up 32 spots on the list, increased demand by 1.3 points, and increased unique prospects per property by 53%.

- Kitchener, ON remained in the same position as this time last year, had a reduced demand of -1.8 points versus this time last year, and saw a reduction of 43% in unique prospects per property.

- Waterloo, ON moved up 10 spots, but decreased demand by 0.7 points, and a decrease in unique prospects per property of 24%.

- Burnaby, BC moved up 2 spots, decreased demand by -1.5, and decreased unique prospects per property by 37% this year versus last year this time.

- Brampton, ON moved down 5 spots on the list, and saw a -2.2 reduction in demand, and a decrease of 52% unique prospects per property.

- Etobicoke, ON moved down 8 spots, reduced demand by 3.1 points, and a decrease of 61% unique prospects per property versus the same time last year.

*The increase in demand found in Oshawa, ON and Nanaimo, BC could be related to remote work and migration to less densely populated areas with reduced rent rates. However, the decrease in demand in the many other cities is directly related to an increase in supply, and not due to a decrease in unique prospects.

*We have an additional 3,053 new properties listed (+35.3%) on ILS's this year versus last, giving the appearance of a poorer performance in 2020 vs 2019, but we actually see a 21.3% increase in total unique prospects versus the same time last year.

*These trends are consistent with what we have witnessed since the beginning of the winter off-season and due the impact of COVID-19 and increasing cases, and stricter government lockdowns during this time, these downward trends are not unexpected.

An Analysis of Key Canadian Markets

In order to better segment our data and analyze what is happening within specific markets across Canada, we have broken down our data into 3 key markets:

- Primary (Populations Over 600K)

- Secondary (Populations Between 600-235K)

- Tertiary (Populations Between 235-175K)

Here we will gain a deeper perspective on demand across larger populations, and any movement due to the impact of COVID-19 on the rental market.

Primary Markets (Populations >600K)

Canadian Cities – Primary Market Drill Down (M/M): Dec 2020 vs. Nov 2020

Notable Changes in Primary Markets Over the Past Month

*Overall demand in primary markets was relatively stable this month versus last month. Overall supply increased by +1.3% in primary markets, however, most cities did not see dramatic fluctuations in demand.

Upward

- North York, ON increased demand by +0.2 and +5% in unique prospects per property this month versus last.

Downward

- Mississauga, ON stayed at 1.4 demand points, and saw a slight decrease of 3% unique prospects per property this month due to an increase in properties available.

- Scarborough, ON reduced demand by -0.3 points and experienced an 21% decrease in unique prospects per property this month. This was the most dramatic decrease in demand for primary markets this month.

- Vancouver, BC also experienced a decrease of -0.2 demand points and a 16% decrease in unique prospects per property this month.

No Change in Demand

- Calgary, AB, Montreal, QC, Toronto, ON, Winnipeg, MB, Ottawa, ON, and Edmonton, AB did not fluctuate in demand month-over-month, and saw very minimal changes to their unique prospects per property.

*Overall, month-over-month demand in primary markets from November to December were mostly stable, and expected due to seasonal shifts in demand and the impact of COVID-19 shutdowns.

Total unique prospects decreased by 2.1% on average for the month and unique prospects per property decreased by 5.1%. (See the year-over-year analysis below, for more perspective on demand decline in primary markets.)

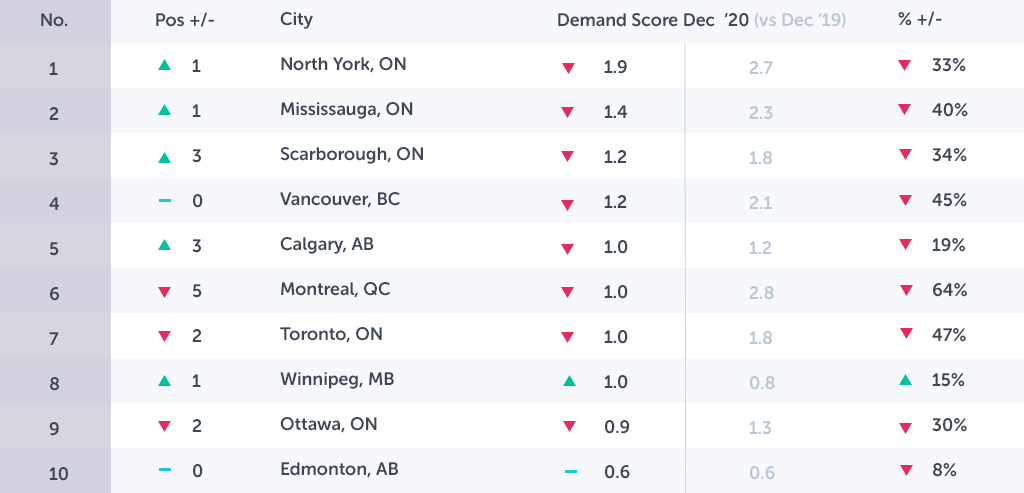

Canadian Cities – Primary Market Drill Down (Y/Y): Dec 2020 vs. Dec 2019

Notable Changes in Primary Market Demand Over the Past Year

*Overall, total unique prospects has increased 16.8% year-over-year in primary markets, however, this year, supply is outpacing demand – listings for rental properties are up 39.6% this year versus the same time last year in primary markets – causing unique prospects per property to drop 30.5% on average year-over-year.

*Due to increased vacancies/availability, supply is outpacing demand 2.5x in primary markets in December of this year.

Upward

- Winnipeg, MB has experienced a slight increase in demand (0.1) from this time last year and has moved up 1 spot in primary markets, and an increase of 15% in unique prospects per property year-over-year.

Downward

- North York, ON saw a decrease of -0.8 in demand and a 33% decline in unique prospects per property this year versus last year.

- Scarborough, ON had a -0.6 point decrease in demand, and a 34% decline in unique prospects per property.

- Calgary, AB saw a -0.2 point decrease in demand, and a 19% decline in unique prospects per property this year versus last.

- Montreal, QC experienced a -1.8 point decrease in demand, and a 64% decline in unique prospects per property from last year.

- Toronto, ON decreased demand by -0.8 points and saw a 47% decline in unique prospects per property.

- Ottawa, ON experienced a -0.4 point decrease in demand, and a 30% decrease in unique prospects per property.

- Edmonton, AB has not changed its position or demand score rating, but has seen a slight decline (-8%) in unique prospects per property.

*According to our data, Western cities in primary markets appear to be less impacted by the effects of COVID-19 on year-over-year demand. However, supply is still outpacing demand in most of these cities.

*Ontario and Quebec have been considered hot beds for COVID-19, and the downward trend in demand and unique prospects per property is likely a reflection of the restrictions and provisions in the primary markets within these provinces.

Secondary Markets (Populations ~600-235K)

Canadian Cities – Secondary Markets Drill Down (M/M): Dec 2020 vs. Nov 2020

Notable Changes in Secondary Market Demand Over the Past Month

*Secondary markets experienced the greatest increase in demand this month (+0.5 this month versus last).

Upward

Surrey, ON increased demand by +0.3 points this month and has seen an increase of 2% in unique prospects per property this month versus last.

Brampton, ON saw an increase of +0.5 in demand, and a 20% increase in unique prospects per property this month.

Etobicoke, ON saw a +0.5 increase in demand, and 17% increase in unique prospects per property.

Victoria, BC saw an increase of +0.1 in demand, and a slight 0.5% decrease in unique prospects per property due to an increase in properties this month versus last.

Quebec City, QC experienced an increase of +0.4 in demand and an increase of 19% unique prospects per property this month.

Downward

- Oshawa, ON saw a decrease of 0.3 demand points and a decrease of 10% unique prospects per property versus last month.

- Hamilton, ON experienced a slight -0.1 decrease in demand and an 8% decrease in unique prospects per property this month versus last.

- London, ON saw a slight decline in demand -0.1 and 10% decrease in unique prospects per property this month versus last month.

- Halifax, NS saw a -0.6 point decrease in demand and a 33% decrease in unique prospects per property, the greatest decline in secondary market cities this month.

- Windsor, ON experienced a decline of -0.1 demand points, and a decrease of 10% unique prospects per property this month.

Canadian Cities – Secondary Market Drill Down (Y/Y): Dec 2020 vs. Dec 2019

Notable Changes in Secondary Market Demand Over the Past Year

*Overall, total unique prospects are up 5.5% in secondary markets this year, however, supply is up 27.4% in secondary markets, therefore supply is outpacing demand by nearly 5x this year versus last year.

Upward

- Oshawa, ON increased demand by +0.9 points and 18% unique prospects per property this year versus last year.

- London, ON increased demand by +0.1 and unique prospects per property by 5%.

- Victoria, BC had a +0.4 increase in demand, and a 27% increase in unique prospects per property versus this time last year.

Downward

- Surrey, BC decreased in demand by -3.9 points and had a 42% decline in unique prospects per property this year versus this time last year.

- Brampton, ON decreased in demand by -2.0 points, and saw a decline in unique prospects per property by 52% this year versus last.

- Etobicoke, ON demand decreased by -3.9 points and saw a 41% decline in unique prospects per property.

- Hamilton, ON decreased in demand by -0.6 points this year and experienced a 54% decline in unique prospects per property this year versus this time last year.

- Halifax, NS saw a 0.9 point decrease in demand and a 41% decrease in unique prospects per property.

- Windsor, ON experienced a -0.3 decrease in demand this year, and a 23% decline in unique prospects per property

No Demand Change

- Quebec City, QC remained steady in demand points and saw a slight 6% decline in unique prospects per property due to a 15% increase in available properties.

*Secondary markets that are close to densely populated areas with less space and higher rental rates, such as Surrey, BC and Etobicoke, ON, are experiencing the greatest decline in secondary market demand. Remote work is making it possible for renters to look to certain suburbs for more affordable housing i.e. Oshawa, ON

Tertiary Markets (Populations ~235-175K)

Canadian Cities – Tertiary Markets Drill Down (M/M): Dec 2020 vs. Nov 2020

Notable Changes in Tertiary Market Demand Over the Past Month

*Unique prospects per property decreased by 11.1% this month versus last month in tertiary markets, with an increase of 4.4% available properties in these areas month-over-month. (See the year-over-year analysis below, for more perspective on the rise in demand in tertiary markets.)

Upward

- Barrie, ON experienced a slight increase in demand (+0.2) and in unique prospects per property (9%) this month versus last month.

- Saskatoon, SK went up +0.1 demand point this month and experienced a slight decline of 1% in unique prospects per property due to more available properties.

Downward

- Kitchener, ON saw a 0.2 decrease in demand and a 9% decline in unique prospects per property this month versus last year.

- Burnaby, BC decreased by 0.1 demand points this month and 8% in unique prospects per property.

- Sudbury, ON saw a -0.4 decrease in demand and a 20% decline in unique prospects per property this month versus last month.

- Oakville, ON went down -0.4 demand points and declined 22% in unique prospects per property.

- Burlington, ON remained steady in demand, and saw a slight 4% decrease in unique prospects per property.

- Nepean, ON decreased demand by -0.2 points and saw a decline of 16% in unique prospects per property this month.

- Richmond, BC experienced a -0.3 decrease in demand points and a 22% decrease in unique prospects per property this month.

- Regina, SK decreased in demand by -0.1 points and -8% unique prospects per property this month.

Canadian Cities – Tertiary Markets Drill Down (Y/Y): Dec 2020 vs. Dec 2019

Notable Changes in Tertiary Demand Over the Past Year

*Overall, total unique prospects are up 17.3% this year versus the same time last year, and number of properties are up 27% this year versus the same time last year, indicating that supply is slightly outpacing demand in tertiary markets this year versus this time last year.

Upward

- Sudbury, ON saw a +0.2 point increase in demand as well as a 10% increase in unique prospects per property this year versus the same time last year.

- Barrie, ON saw a +0.2 point increase in demand this year, and a 9% increase in prospects per property versus last year.

- Richmond, BC experienced the greatest increase in demand, increasing +0.7 demand points and 57% unique prospects per property this year versus this time last year.

- Saskatoon, SK increased its demand by 0.2 points and unique prospects per property by 17% this year versus the same time last year

Downward

- Kitchener, ON decreased demand by -1.6 points and unique prospects per property by 43% this year versus last year.

- Burnaby, BC decreased demand by -1.1 points and -37% unique prospects per property from this time last year.

- Oakville, ON saw a decrease in demand by -3.5 and a 62% decline in unique prospects per property this year versus this time last year, the biggest decline (equal to Nepean, ON) by tertiary cities this year versus last year.

- Burlington, ON saw a 0.2 point decrease in demand, and a 17% decrease in unique prospects per property this year versus this time last year.

- Nepean, ON experienced a 1.9 point decline in demand, and a 62% decrease in unique prospects per property versus this time last year.

No Change in Demand

- Regina, SK did not change in demand this year versus the same time last year and saw a slight decline (-4%) in unique prospects per property this year versus this time last year due to a 23.3% increase in available properties.

Conclusion

The data shown in this report show that rental market demand has declined slightly in many Primary, Tertiary, and some Secondary cities month-over-month, but is showing great stability despite seasonal shifts in demand and the impact of COVID-19 shutdowns. In fact, some Secondary markets are actually experiencing an increase in demand, as renters continue to search for deals and promotions during lockdown.

Additionally, there are notable year-over-year changes in demand in certain markets. Primary markets continue to indicate declining demand, where some secondary and tertiary markets are seeing a year-over-year increase in demand due to migration away from city centers. Areas with lower population and more affordable housing are seeing the greatest increase in demand.

We will continue to monitor, and provide an in-depth data analysis, month-over-month, and year-over-year to provide you with the most accurate insights that can help to support your ongoing marketing and advertising strategies, especially as we navigate through these unprecedented times.